north carolina estate tax id

Other entities also use EINs. Under North Carolina General Statute 105-289 The Department of Revenue is charged with the duty to exercise general and specific supervision over the valuation and taxation of property by taxing units throughout the State.

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

For example it is used as the estate of a deceased individual tax ID.

. The estate pays any debts owed by the decedent and distributes the balance of the estates assets to the beneficiaries of the estate. Popular Searches on ncsosgov. 1301 Mail Service Center Raleigh NC 27699-1301.

North Carolina Secretary of State. List appraise assess and collect all real and personal property for ad valorem tax purposes in compliance with NC. An EIN is an acronym that stands for Employer Identification Number.

Welcome NC 27330 business by the IRS and ser. North Carolina does have income tax but it doesnt have an estate tax or gift tax. 10 rows Property Tax Collections Past Due Taxes Business Registration Information for Tax.

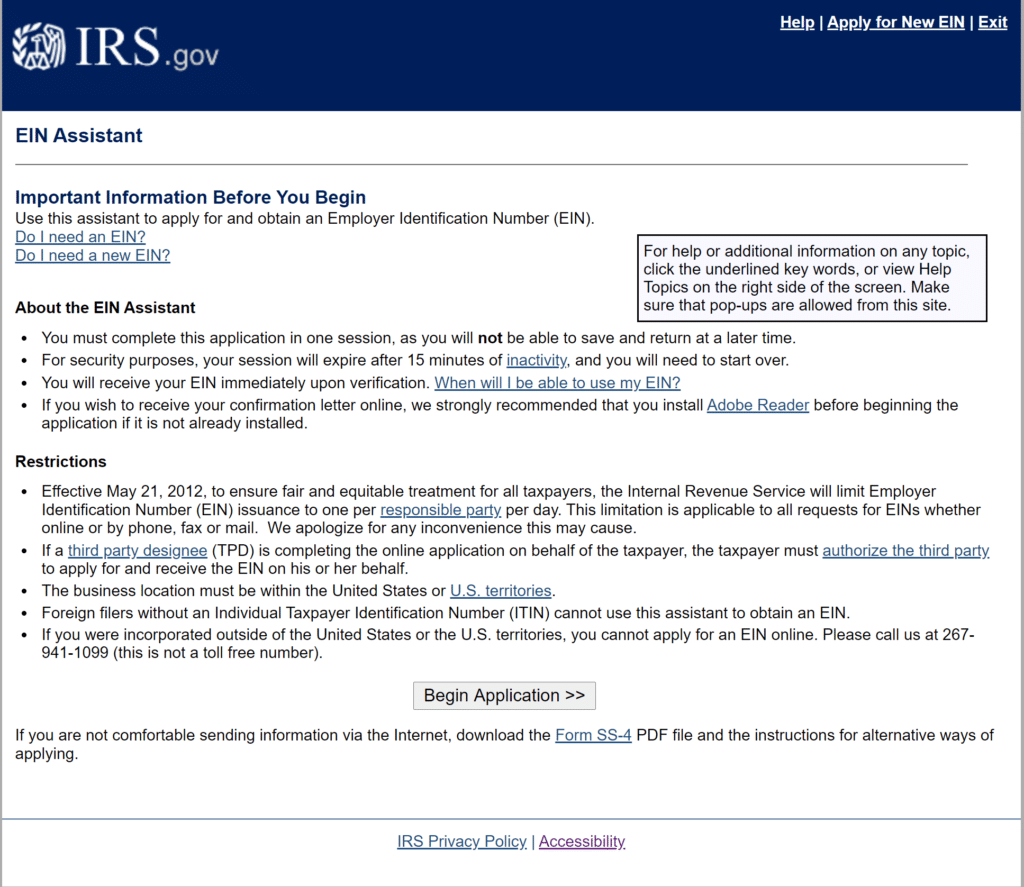

It is a number issued to a business by the Internal Revenue Service IRS and not the State of North Carolina. Obtain your Tax ID in North Carolina by selecting the appropriate entity or business type from the list below. Download our FREE eBook guide to learn how with the help of walking aids like canes walkers or rollators you have the opportunity to regain some of your independence and enjoy life again.

Apply in 3 Simple Steps. A tax ID number in NC is similar to an EIN. File Tax Returns for Employment.

A North Carolina Federal Tax ID Number which is also known as an Employer ID Number EIN or Federal Tax Identification Number is a unique nine-digit ID assigned by the Internal Revenue Service for tax purposes for businesses as well as Non-Profit organizations Trusts and Estates. If the estate exceeds the federal estate exemption limit of 1206 million it becomes a subject for the federal estate tax with a progressive rate of up to 40. Therefore the North Carolina estate tax is equal to the 2001 state death tax credit for estates of decedents dying before July 1 2005.

Operate as Trust Estate or Non-Profit Organization. Business Registration Assumed Business Names Authentications Business Opportunity Sales Cable TV Franchises Camping Membership Registrations Charities Fundraisers Federal Tax Liens Notary Land Records Loan Broker Registrations Lobbying Compliance Service Of Process Trademarks Uniform Commercial Code UCC About. North Carolina Department of Administration.

An SSN is an identifying. 2 Complete the Form. A valid North Carolina driver license or ID issued after.

If a North Carolina resident inherits a property. Yes Estates are required to obtain a Tax ID. 1 Select Entity Type.

ESTATE TAX ID EIN APPLICATION. Pay at the Tax Collectors office on the first floor of the Union County Government Center Monday through Friday between 800 am. Make sure you review your estate situation with a qualified attorney and tax professional.

An estates tax ID number is called an employer identification number or EIN and comes in the format 12-345678X. An Estate consists of the real andor personal property of the deceased person. North Carolina Secretary of State Business Registration Get a Federal and State Tax Id Number.

Catawba County Tax Department. Estate tax mediation can take various forms and should start as soon as possible. How can we make this page better for you.

Intellectual Property NASAA - North American Securities Administrators. However there are 2 important exceptions to this rule. An EIN is also called a Federal Tax ID number or Tax ID number TIN.

2 South Salisbury St. Once your application has been submitted our agents will begin on your behalf to file your application and obtain your North Carolina Tax ID. Think of a TIN exactly like a social security number.

Before filing Form 1041 you will need to obtain a tax ID number for the estate. North Carolina Secretary of State Business Registration Get a Federal and State Tax Id Number. Search Catawba County property tax assessment records by address owner name subdivision parcel id or book and page number including GIS maps.

A tax ID number in NC is similar to an EIN. Pay tax bills online file business listings. Search sosncgov Search Text.

105-322a North Carolina imposes an estate tax on the estate of a decedent when a federal estate tax is imposed on the estate and the decedent was either 1 a resident of North Carolina. If you want to establish a credit history for your business you will need an EIN. Uncategorized north carolina estate tax id.

100-A SW Boulevard Newton NC 28658. Other entities also use EINs. A tax ID number in NC is similar to an EIN.

These should all be considered when you look at the overall state tax structure. Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state. North Carolina Department of Administration.

The decedent and their estate are separate taxable entities. What North Carolina Residents Need To Know About Federal Capital Gains Taxes Whats New for 2022 for Federal and State Estate Inheritance and Gift Tax Law. Tax Assessor and Delinquent Taxes.

The Property Tax Division of the North Carolina Department of Revenue is the division responsible for this administration. Division Contacts Phone Numbers. State Property for Sale Property Search.

Yes Estates are required to obtain a Tax ID. Menu NC SOS Search. Before filing Form 1041 you will need to obtain a tax ID number for the estate.

Ein Comprehensive Guide Freshbooks

Nc Real Id Your Questions Answered Raleigh News Observer

Official Ncdmv Pay Property Tax On Limited Registration Plates

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Free North Carolina Real Estate Purchase Agreement Template Pdf Word

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Income Tax Calculator Smartasset

Ein Comprehensive Guide Freshbooks

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

North Carolina Sales Tax Small Business Guide Truic

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

North Carolina Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Motor Vehicles Information Tax Department Tax Department North Carolina

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

States With No Estate Tax Or Inheritance Tax Plan Where You Die