colorado springs sales tax rate 2019

Ad Get Colorado Tax Rate By Zip. Lakeside Auto Brokers is a used car dealership located near Colorado Springs Colorado.

80901 80902 80903.

. A repair shop charges a flat rate of 2995 for a standard. Intended to be substituted for the full text within the City of Colorado Springs Tax Code. OBrien Sharon Created Date.

Box 1575 Colorado Springs CO 80901-1575. Retailers that make deliveries must collect and remit a 027 retail delivery fee for each sale of taxable tangible personal property delivered by motor vehicle to a location in Colorado. For Filing Period Ended December 31 FINANCE DEPARTMENT Month Paid to City.

Colorado Springs CO 80903 Sales Tax Reports Sales and Use Tax Revenue Reports are prepared and released each month. City of Colorado Springs Sales Tax Contact Information. The County sales tax rate is.

Free Unlimited Searches Try Now. The December 2020 total local sales tax rate was 8250. The 2018 United States Supreme Court decision in South Dakota v.

Colorado has recent rate changes Fri Jan 01 2021. Retail Delivery Fee RDF Effective July 1 2022. The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales taxesThe local sales tax consists of a 123 county sales tax a 312 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc.

OBrien Sharon Created Date. SERVICE SALES PAGE 2 Common examples continued 3. Colorado state sales tax is imposed at a rate of 29.

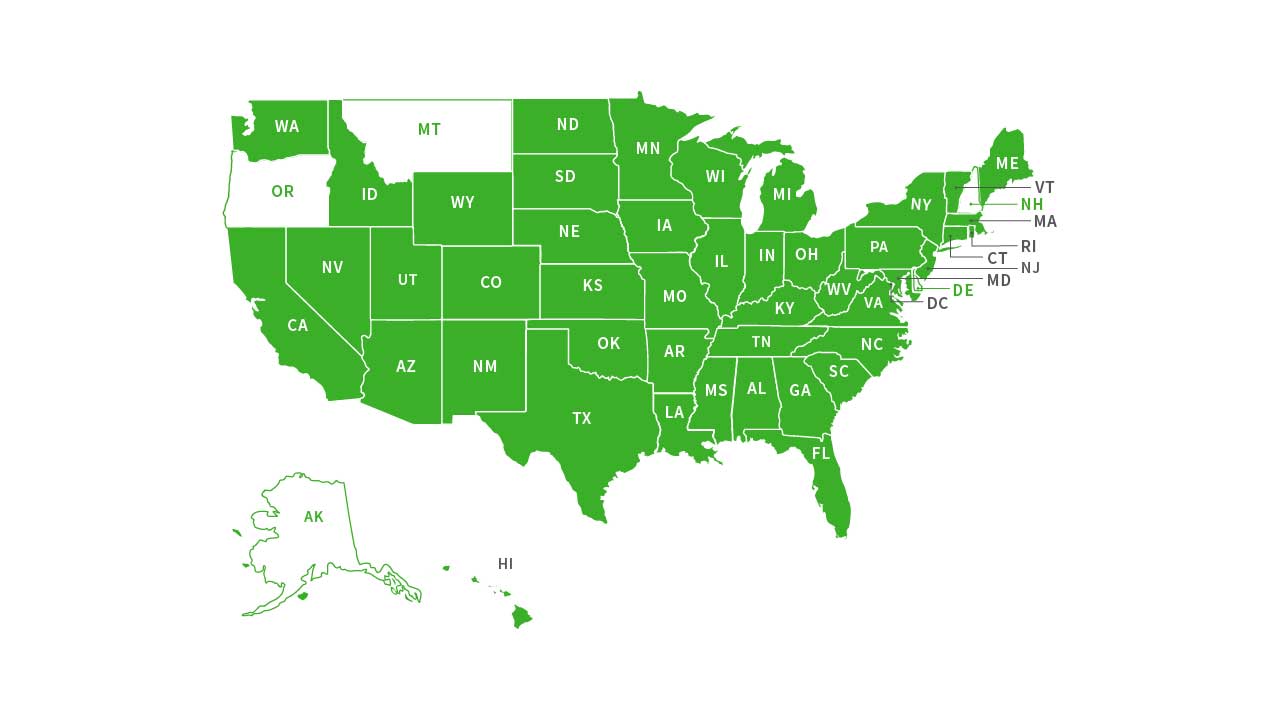

Select the Colorado city from the list of popular cities below to see its current sales tax rate. City sales tax collected within this date range will report at 312. 2212019 34338 PM.

The filing period captures the tax collected by the retailer from their customers. Colorado has recent rate changes Fri Jan 01 2021. July to December 2019.

Sales Tax Breakdown Colorado Springs Details Colorado Springs CO is in El Paso County. The Colorado Springs sales tax rate is. It also contains contact information for all self-collected jurisdictions.

Use tax is due within the same filing period in. City of Colorado Springs Tax Guide TAX ISSUE-176 CITY OF COLORADO SPRINGS Use Tax. Thats why the City Council voted unanimously to refer a five year renewal of Issue 2C to the November 2019 ballot.

If your business is located in a self-collected jurisdiction you must apply for a sales tax account with that city. The current total local sales tax rate in Colorado Springs CO is 8200. The collection month listed below represents the month the revenue was paid to the City for the filing period ending the previous month.

The sales tax rate. The County sales tax rate is. Higher sales tax than 74 of Colorado localities 27 lower than the maximum sales tax in CO The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax.

City of Colorado Springs Sales Tax 30 South Nevada Avenue Ste 203 Colorado Springs CO 80903 8-5pm M-F. City of Colorado Springs Sales and Use tax rate is 312 city collected State of Colorado 29 El Paso County Rate is 123 PPRTA Rate is 10 all 3 entities state collected 513. Colorado Springs is in the following zip codes.

Colorado Springs Colorado Sales. Colorado CO Sales Tax Rates by City The state sales tax rate in Colorado is 2900. Restaurant must charge city tax at the discounted rate for the.

The arguments in favor of the measure as provided in the Colorado Springs November 2019 election notice are. If passed the sales tax rate will be lowered from 62 percent to 57 percent beginning in 2021 upon the conclusion. City of Colorado Springs Sales Tax 30 South Nevada Avenue Ste 203 Colorado Springs CO 80903 8-5pm M-F.

This is the total of state county and city sales tax rates. In November of 2019 voters in Colorado Springs passed Issue 2C2 agreeing to continue investment in our roads for years 2021-2025 at a sales tax rate of 057 reduced from 062 for Issue 2C that was passed by voters in November 2015 for years 2016-2020. City of Colorado Springs Sales Tax PO.

Instructions for City of Colorado Springs Sales andor Use Tax Return 307 Sales and Use Tax Return 307 Sales and Use Tax Return in Spanish January 1 2016 through December 31 2020 will be subject to the previous tax rate of 312. Colorado Springs voters passed Issue 2C2 in November 2019 authorizing continuation. 1195 for oil and the oil filter and 1800 for labor.

This document lists the sales and use tax rates for all Colorado cities counties and special districts. Any sale made in Colorado may also be subject to state-administered local sales taxes. City of Colorado Springs Tax Code 012019 Question.

City of Colorado Springs Tax Code. An automobile repair shop performs oil changes and invoices their customers for 2995. Calendar year Discounted rate Regular rate 2019 5 8 2020 6 9 2021 3 6 2022 3 6.

For a Retail Sales Tax License make check payable to the City of Colorado Springs. CITY OF COLORADO SPRINGS Service Sales. Wayfair Inc affect Colorado.

For a Retail Sales Tax License make check payable to the City of Colorado Springs. Box 1575 Colorado Springs CO 80901-1575. Has impacted many state nexus laws and sales tax collection requirements.

The sales tax amounts to 93 in the city and lodge guests pay a 2 bed tax on top of that. With local taxes the total sales tax rate is between 2900 and 11200. You can print a.

City of Colorado Springs Sales Tax PO. 719-385-5291 Investigator Line. In November of 2019 voters in Colorado Springs passed Issue 2C2 agreeing to continue investment in our roads for years 2021-2025 at a sales tax rate of 057 reduced from 062 for Issue 2C that was passed by voters in November 2015 for years 2016-2020.

312 City of Colorado Springs self-collected 200 General Fund 010 Trails Open Space and Parks TOPS 040 Public Safety Sales Tax PSST 062 2C Road Tax 290 State of Colorado 123 El Paso County 100 PPRTA Restricted Use. TOPS PSST 2C Road Tax. Did South Dakota v.

Download and file the Retail Delivery Fee Return DR 1786 to register a Retail Delivery Fee account. The Colorado sales tax rate is currently.

Florida Sales Tax Rates By City County 2022

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Sales Tax Information Colorado Springs

Financial Tip Of The Month Tax Prep Checklist Tax Prep Checklist Tax Prep Small Business Tax

California Sales Tax Rates By City County 2022

The Consumer S Guide To Sales Tax Taxjar Developers

Sales Tax Information Colorado Springs

Ay 2020 21 Income Tax Return Filing Tips Which Itr Form Should You File Income Tax Return Income Tax Return Filing Income Tax

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

Taxes In Colorado Springs Living Colorado Springs

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Colorado Sales Tax Rates By City County 2022

The Consumer S Guide To Sales Tax Taxjar Developers

Sales Tax Information Colorado Springs

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate